Wealth populations

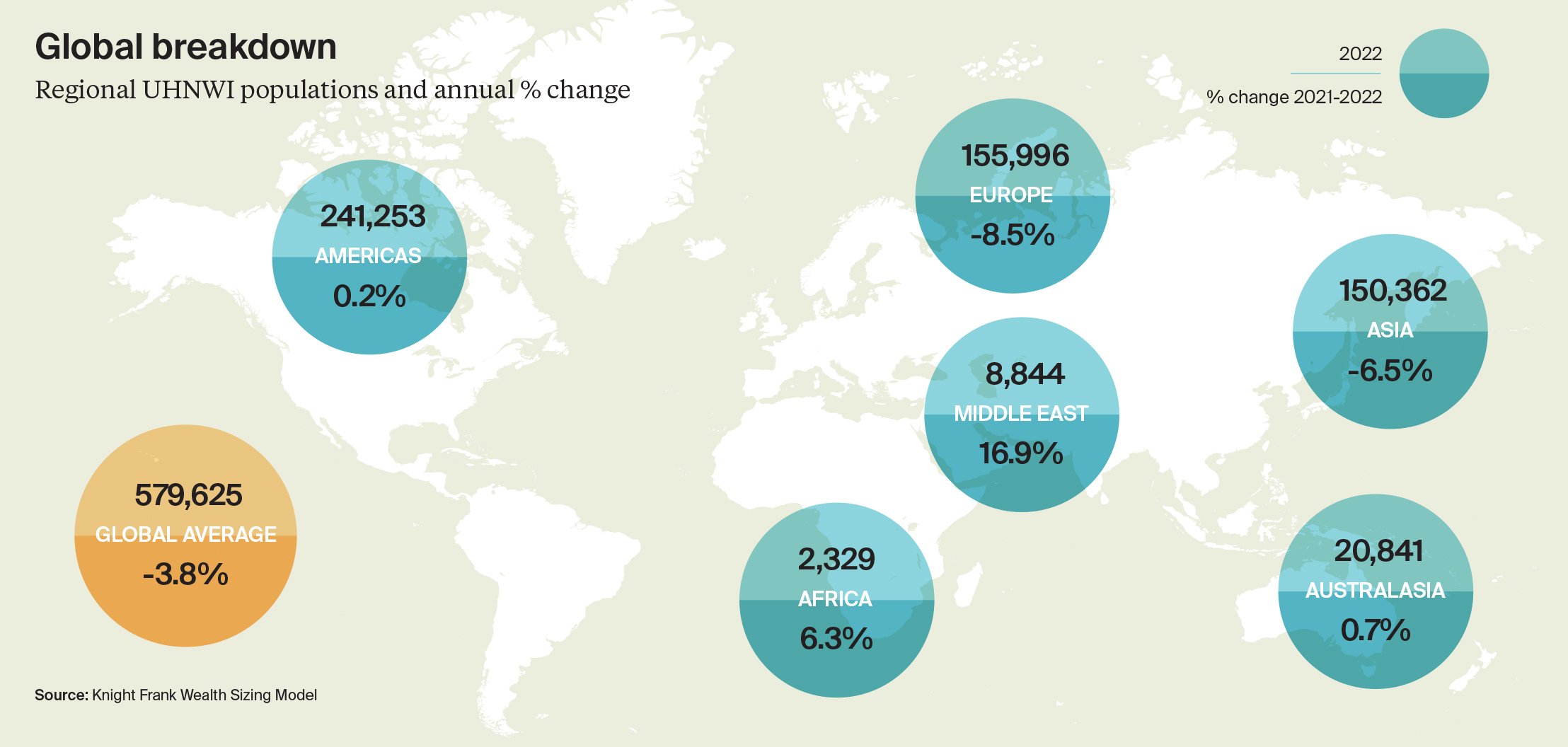

Global population of UHNWIs declined by 3.8% in 2022 after 9.3% record growth in 2021

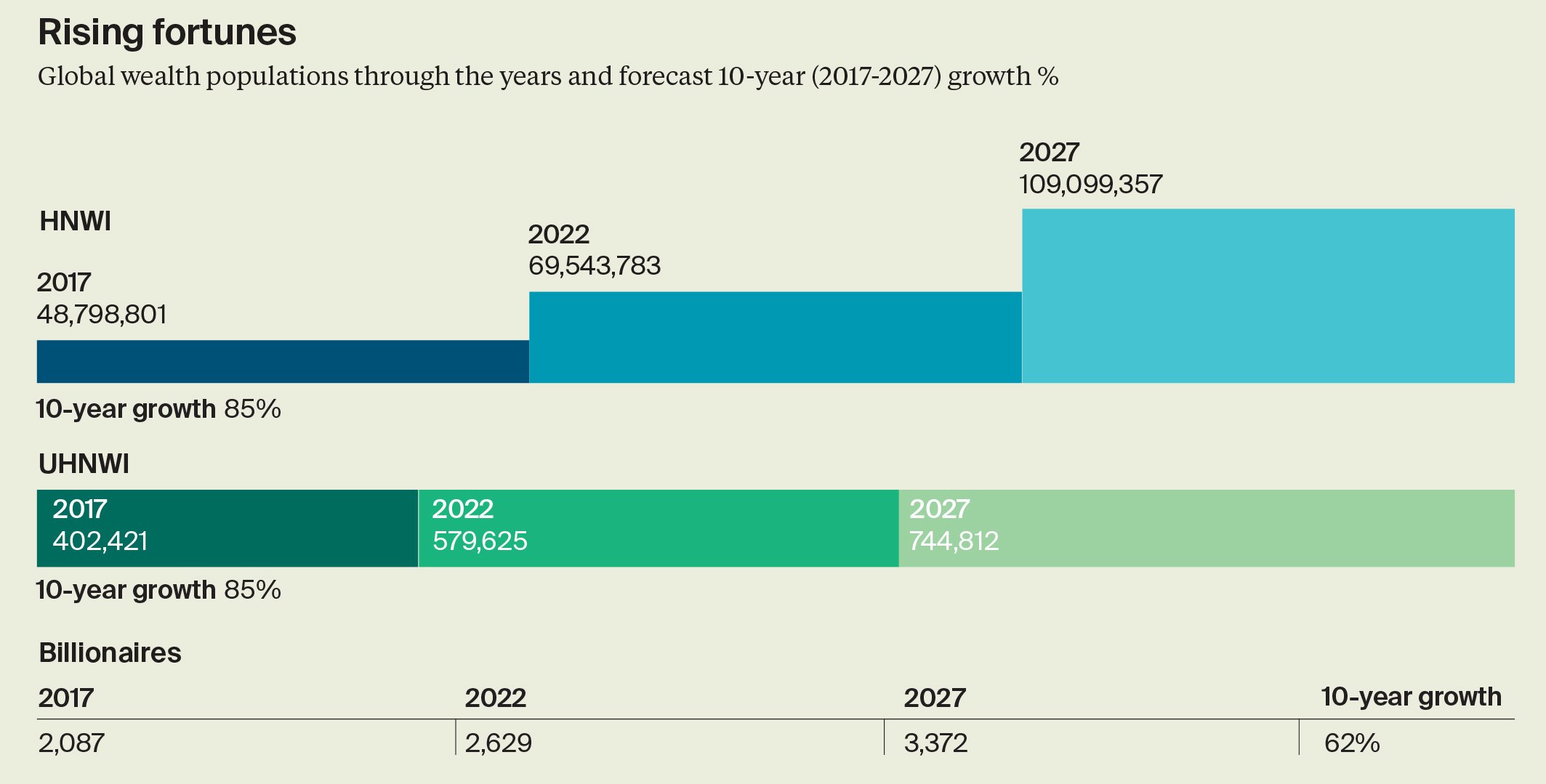

According to the latest issue of The Wealth Report by Knight Frank, the global population of ultra-high-net-worth individuals (UHNWIs) declined by 3.8% in 2022, after a record climb of 9.3% in 2021. Despite the fall however, several growth hubs remained both at a regional and country level as well as across wealth bands – billionaires, UHNWIs and high-net-worth individuals (HNWIs).

Highlights:

The Middle East was the regional stand-out with the number of UHNWIs growing by 16.9%

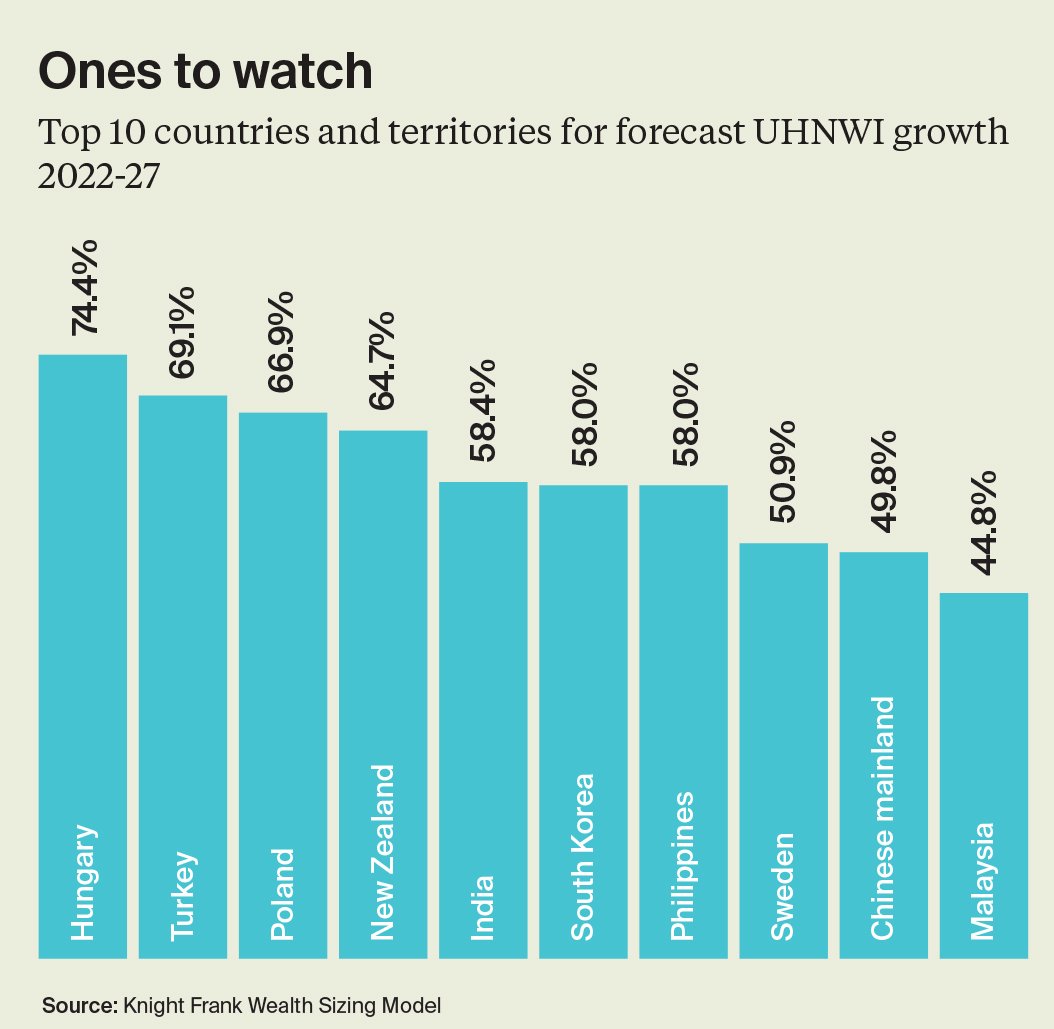

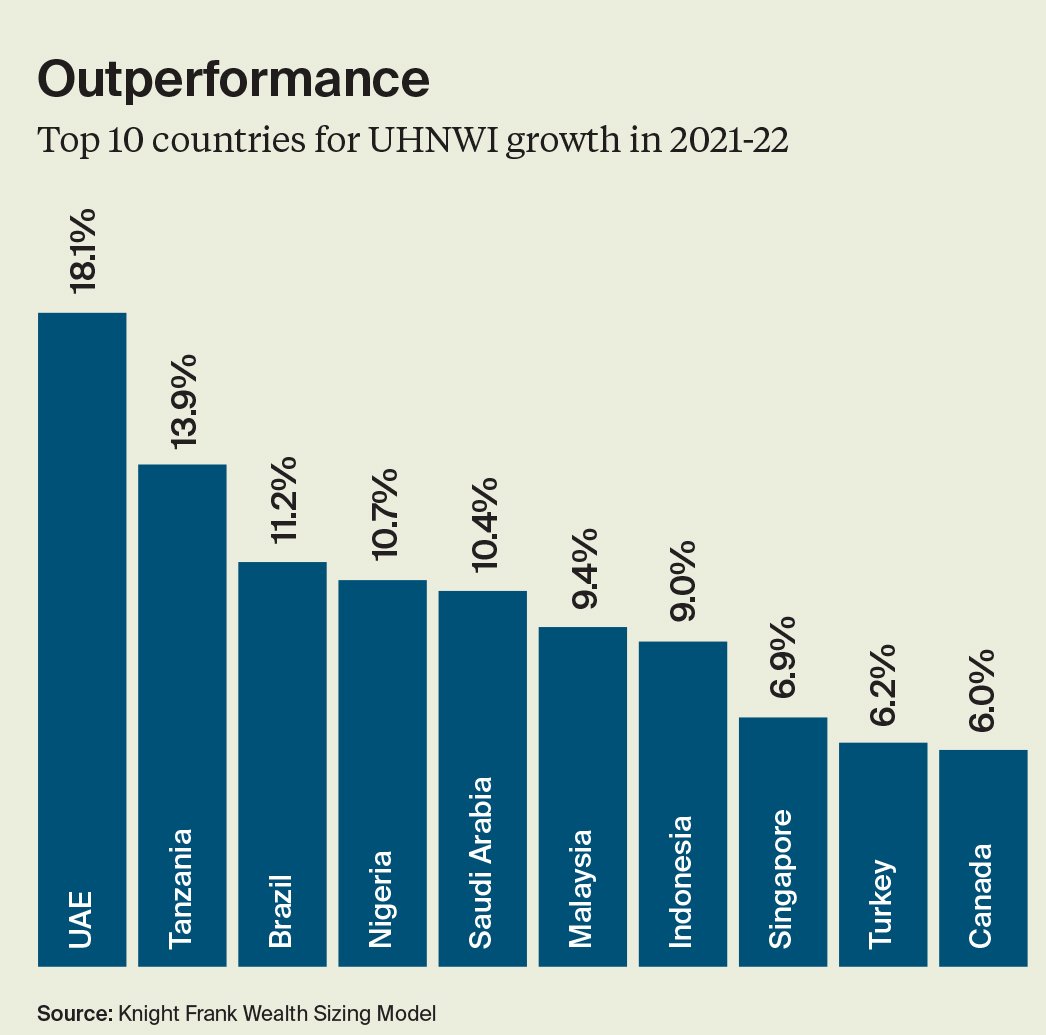

Three of the top 10 fastest growing UHNW markets were in Asia with Malaysia, Indonesia and Singapore seeing their wealth populations expand by 7-9%, this comes despite the wider region experiencing a 6.5% decline

Over the next five years, Knight Frank forecasts that the global UHNW population will expand by 28.5% to almost 750,000 from 579,625 in 2022

Liam Bailey, global head of research at Knight Frank said: “The fall last year in the total number of UHNWIs globally was due in large part to the weak performing equities and bond markets. On the flip side however, 100 prime residential markets globally saw average price growth of 5.2% and luxury investment assets grow 16% which helped steady the decline. The dip is just that. Taking the longer view, the global UHNW population grew by 44% in the five years to 2022 and, although we forecast growth to slow to 28.5% over the next five years, the recent dip will prove short lived as we adapt to a new economic environment.”